Students from CRHS and TFHS MVSL took a trip to the Twin Falls Historical Museum to dive into the rich history of our community! 🏔️📖 It was a great opportunity to learn about the past.

#MVSL #HistoryComesAlive #TwinFallsHistory

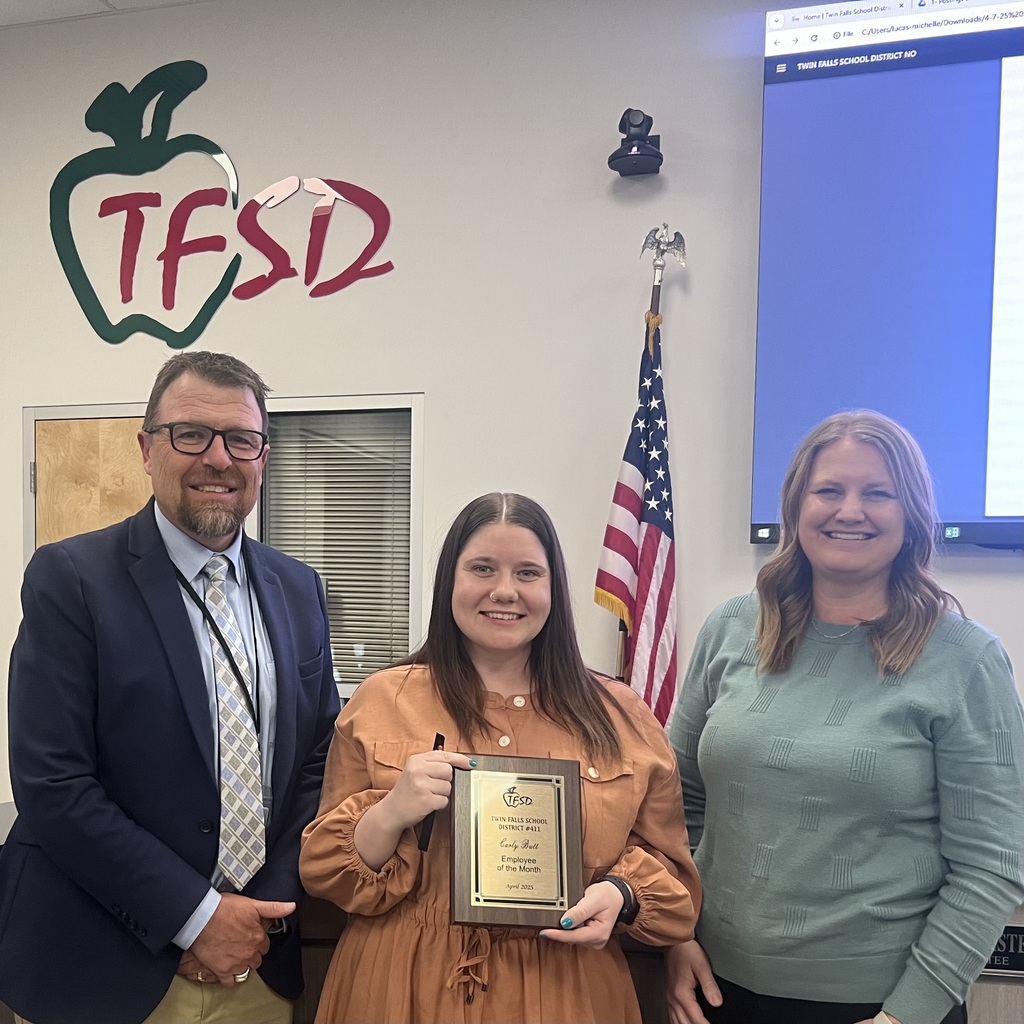

🌟 Certified Employee of the Month: Carly Butt! 🌟

Let’s give a big round of applause to Carly Butt, Certified Employee of the Month for April and kindergarten teacher at Rock Creek Elementary School! 👏🍎

Originally from Bellflower, California, Carly became a teacher to share her love of learning and to create a classroom that’s safe, loving, and full of fun. One of her favorite things? When students actually laugh at her jokes! 😄

Described in one word as loyal, Carly draws daily inspiration from her incredible teaching partners, who help her grow. She loves reading, sipping coffee (just not lukewarm!), and exploring Idaho adventures with her husband and their dog. 🐾☕📚 One day, she hopes to visit Ireland! 🍀

For Carly, the best days on the job are whenever she can smile and laugh with her students—because learning should always be fun! 💛

💬 Principal Note:

“Carly is truly a ray of sunshine at Rock Creek. She’s always positive, loving, and brings humor to the classroom that makes learning joyful. Her compassion, warmth, and ability to see the good in everyone uplift both students and staff alike. We are so lucky to have her!”

#EmployeeOfTheMonth #RockCreekPride #KindergartenMagic

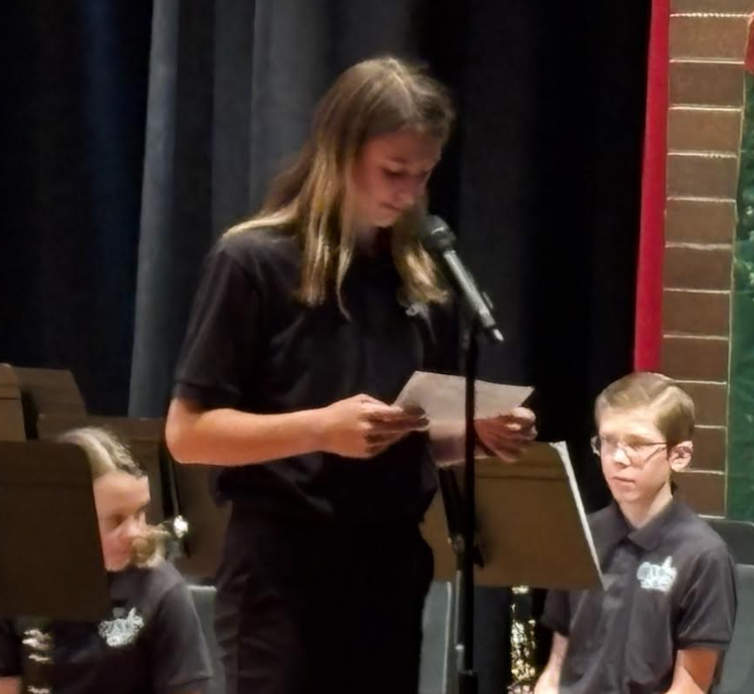

Mr. Dave Gibson hosted his Spring Concert at O’Leary Middle School, featuring the beginning, intermediate, and advanced bands! 🎼✨ Students introduced each piece before performing, with Mr. Gibson conducting the talented musicians.

The audience was blown away by the outstanding performances!

🎵🎉 Way to go, O’Leary bands! #OLearyMusic #SpringConcert #FutureMaestros

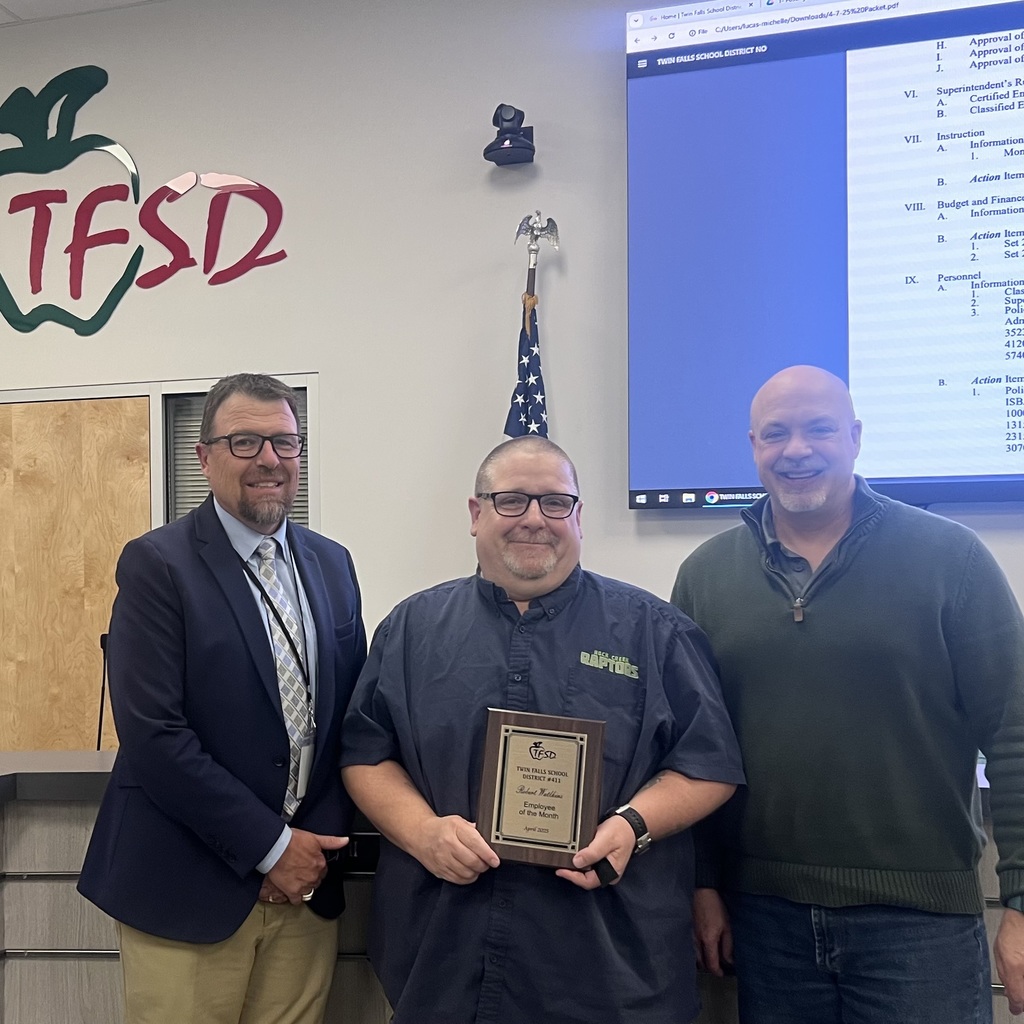

👏 Hands Together for Our Classified Employee of the Month for April: Robert Watkins! 👏

Robert Watkins is the head custodian at Rock Creek Elementary School! 🧹🏫

He was born and raised in Twin Falls and loves watching baseball with his wife and close friends. ⚾ One word that sums him up? Caring. 💙

Robert draws inspiration from his wife, whose dedication to her students—whether in the classroom or on the field—motivates him every day. He chose his career because of the people he gets to work with, and he hopes to be remembered for being him.

One day he would like to watch a game at every MLB stadium. And his favorite moments on the job? Every time a student calls out, “Hi Mr. Wobert!” 🥹

💬 Principal Note:

“Robert is an absolute gem in every way. He’s incredibly kind and helpful, always takes on projects without hesitation, and makes sure everything at Rock Creek runs smoothly. He even helps run the chess club after school on Mondays! His sense of humor and positive energy are contagious. The kids absolutely adore him, and so do we!”

#EmployeeOfTheMonth #RockCreekRocks

Fourteen students from CRHS competed at the HOSA State Conference, showcasing their skills in future health professions! They all performed exceptionally well, and one student even earned a scholarship! 🎓👏

💙 #FutureHealthcareLeaders #CRHSHOSA #StudentSuccess

🎤🌸65 students from Rock Creek Elementary (3rd-5th grade), led by Ms. Cami Dry, put on a fantastic "Groovy" concert featuring hits from the ‘60s & ‘70s! 🎸🕺

But they didn’t stop there! Later they took their show on the road, performing for residents at three local retirement homes. 💕🎶 The day ended with a fun celebration at Bowladrome.

🌟 #GroovyTunes #RockCreekChoir #MusicInTheCommunity

🎒✨ Kindergarten is a big step, and we’re here to help! Join your school’s Kindergarten Open House to meet teachers, tour classrooms, and get all your questions answered. Plus, early registration ensures a smooth start for your child!

📅 Children who turn 5 on or before Sept. 1, 2025, are eligible to enroll.

🔗 Register today: https://www.tfsd.org/page/kindergarten-registration

🎸🔥 Battle of the Bands Returns to TFHS! 🎶🎤

For the first time in 11 years, TFHS hosted an epic Battle of the Bands. It was opened to Magic Valley students!

🏆 Winners:

🥇 Mariachi Juvenil del Valle Mágico – TFHS

🥈 [2B Determined] – TFHS

🥉 The Curve – CRHS

🎶🤘 #TFHSBattleOfTheBands #MagicValleyMusic #StudentTalent

🎉 Classified Employee of the Month: Wendy Maughan! 🎉

A huge congratulations to Wendy Maughan, computer lab paraeducator at I.B. Perrine Elementary School and Classified Employee of the Month for April! 🖥️✨

Originally from Boise, Idaho, Wendy is described best in one word: kind. 💛 When she’s not helping students, you might catch her playing her guitar 🎸

Wendy was inspired to pursue her career by a love of lifelong learning, and she’s passionate about helping kids become lifelong learners too. Her best day on the job? The moment she conquered Google Classroom—it made everything better! 🙌

Principal Note:

“Wendy is new to Perrine and the Computer Lab position this year, but you’d never know it! She’s a ray of sunshine and always willing to help wherever needed. We are so lucky to have her at Perrine. Thank you, Wendy, for always going above and beyond!”

#EmployeeOfTheMonth #PerrinePride

🎓All TFHS 9th graders had the exciting opportunity to attend CTE Freshman Day at CSI! Students explored career pathways, participated in hands-on activities, and learned about programs designed to help guide their future career decisions. 🔎💡

👏 #CTEFreshmanDay #FutureReady #TFHS

🎉 Congratulations to Adam Wright – Your New Mr. TFHS! 🎉

Last Wednesday, nine senior contestants took the stage at TFHS, each accompanied by their chosen escorts and guided by the one and only MC Joey Bravo from Music Monster 92.7! After a night of fun, talent, and fierce competition, Adam Wright emerged victorious, earning the coveted Mr. TFHS title.

#MrTFHS #TFHSpride #CongratsAdam

🌟 Certified Employee of the Month: Trina Waugh! 🌟

Please join us in congratulating Trina Waugh, fourth-grade teacher at I.B. Perrine Elementary School, for being named our Certified Employee of the Month for April! 👏🍎

Currently living in Burley, Trina has had quite the journey and moved around a lot—describing herself with one perfect word: miscellaneous! Her favorite hobby? Sleeping 😴. Her least favorite thing? Cotton balls One day, she dreams of visiting Australia. 🐨

Trina became a teacher to make even one minute feel safer and better for a child. Inspired by her grandma and three teachers from Wells, Nevada, she strives every day to make a difference For Trina, the best day at work is any day she sees a child smile. ❤️

💬Principal Note:

"Trina is a fantastic teacher! She is engaging, caring, and compassionate. She builds strong relationships with her students and they work hard for her. Perrine is fortunate to have her. Thank you, Trina, for all you do!"

#EmployeeOfTheMonth #ThankATeacher #PerrinePride

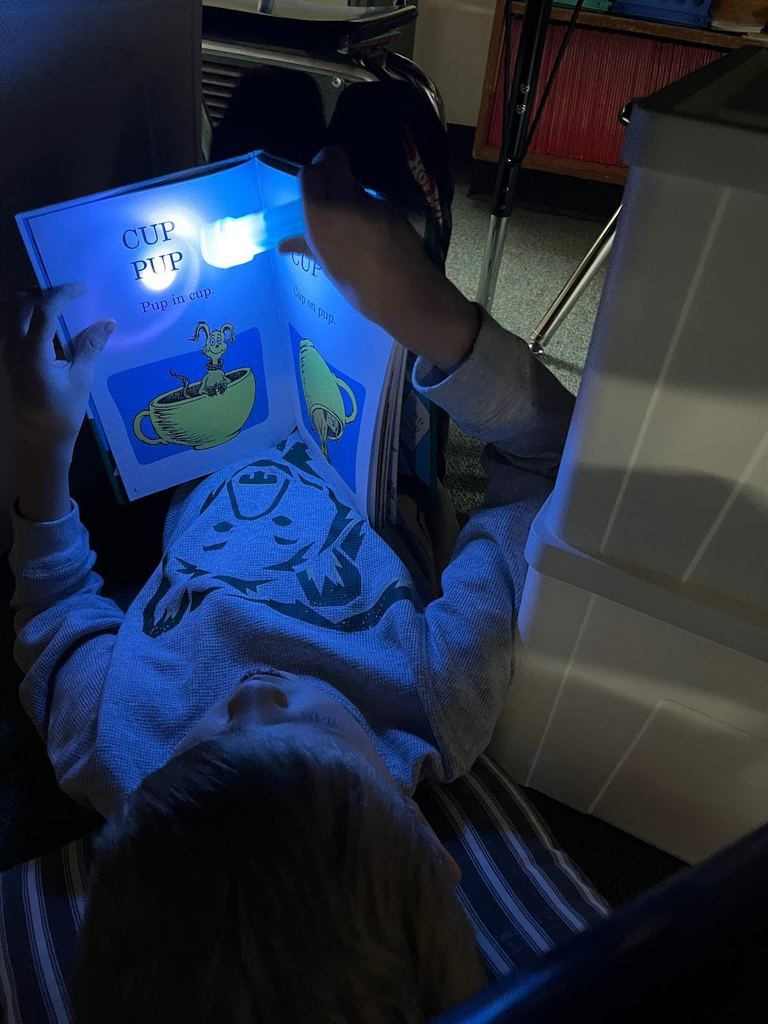

Students at Harrison Elementary honored Dr. Seuss and the joy of reading with a week full of fun! Each child received a new book to take home, dressed up in creative outfits, and wrapped up the week with a pajama day and flashlight reading! 🌙📖✨

📚💙 #ReadAcrossAmerica #DrSeussWeek #LoveForReading

🎉 25th Anniversary Spring Showcase 2025

Jive presents:

🌧️ Singin' in the Rain

April 23–26 at 7:00 PM

April 26 also has a matinee at 2:00 PM

📍 Location:

Roper Auditorium

🎟️ Ticket Prices:

Student: $8

Adult: $10

Livestream: $20

Family: $30

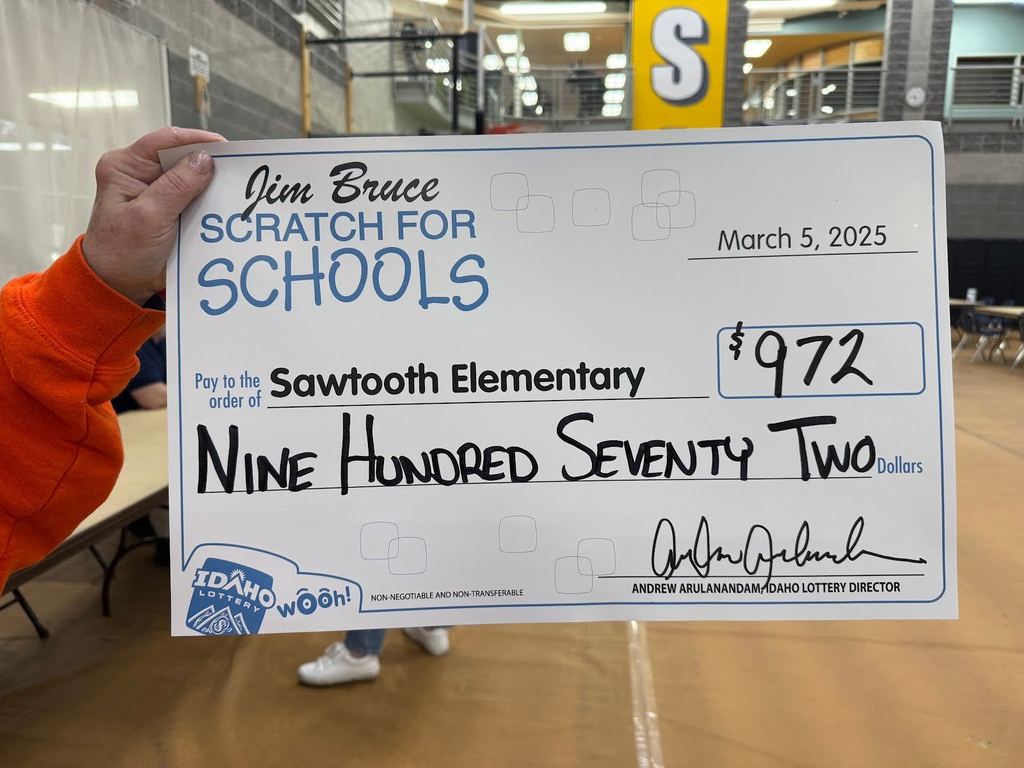

💰🎉Our amazing team from Sawtooth scratched 199 out of 200 tickets and took home a whopping $972.00 – the top amount for the night! 🏆👏

🎟️💵 #ScratchForSchools #WinningBig #SawtoothSuccess

📅 Save the Date!

Join us for Engage in Education — a fun and free community picnic celebrating public schools!

🗓 Wednesday, May 7 | ⏰ 4:30–7:00 PM

📍 Twin Falls City Park

Enjoy student performances, school booths, and a free hot dog dinner (first 4,000 guests)!

#WeAreTFSD #EngageInEducation

Oregon Trail kicked off their Ready for Kindergarten series with an awesome math session! 📚✨ It was great to see parents from different school zones come together, and we're excited to share that three families are planning to enroll in our dual immersion Spanish Kindergarten! 🌟

There are three more sessions to go—can't wait for what's next!

#ReadyForKindergarten #OregonTrailElementary #DualImmersion #FutureStudents #MathFun #KindergartenReady

🏀🎉 Congratulations to the TFHS Boys' Basketball Team! Our Bruins brought home 3rd place at the State Tournament last weekend! 🏆🔥 What an incredible season! 💪👏

Way to go, Bruins! 🐻💙 #TFHSBasketball #StateTournament #BruinPride

TFSD Dual Immersion Program! Applications are open now! The Interested Parent Meeting is on April 29, 6 p.m., at Bickel Elementary School.

🚨 We need YOUR input! 🚨 TFSD is updating our five-year strategic plan, and we want to hear from parents, staff, students, and community members. Take our Strategic Planning Survey and help shape the future of our schools! 🏫✏️

📋 Take the survey here: https://forms.gle/MnFXDtjuzYwAx2fp8

🗓 Survey closes April 13, 2025

#TFSD #YourVoiceMatters #FutureOfEducation